The Definitive B2B Buyer Persona

A buyer persona marketing & sales teams can actually use.

For real.

Buyer personas are divisive in B2B

Some teams use them. Others think personas are useless.

The problem isn’t having personas.

The problem is B2B teams aren’t building the personas they need to make informed decisions. This leads to marketing and sales programs that aren’t effective in growing the business.

I made a FREE template (available in four formats) you can download now. No strings.

But if you scroll down I’ll walk you through where personas came from, why B2B Buyer Personas need to be different, and real-life examples of what a good one looks like.

A (Very Brief) History of Market Segmentation

The modern “persona” is usually attributed to software programmer Alan Cooper. Angus Jenkinson and Ogilvy get credit for evolving these into marketing personas. Yet, Buyer Personas have their roots in market segmentation; when demographics, psychographics and other data are used to categorize buyer groups.

Market segmentation dates back thousands of years to the bronze age. Traders mapped different routes to understand “settlement patterns and infrastructures, the scale of agriculture and craft-production, the internal economic and social organization” (The Routledge Companion to Marketing History, Oxon, Routledge, 2016).

Merchants wanted a deeper understanding of buyers and how to communicate their offerings effectively.

By the 18th century, segmentation had evolved further. Book manufacturers began producing varying tiers of book quality tailored to class, household type, age, and other factors. Previously, reading was accessible only to the wealthy, but this shift allowed manufacturers to target sub-segments like children, women, public libraries, and schools. Furniture manufacturers began catering specifically to hotels and hospitals.

A century ago, the soaring demand for manufactured products and goods formalized philosophies and language around segmentation. Demographic, socioeconomic, and lifestyle factors became central to marketing strategies, enabling businesses to decide which buyer groups to target or avoid. These refined segmentation methods improved marketing investments and increased the likelihood of influencing ideal customers' buying decisions. Buyer personas naturally evolved from these practices.

Here’s the key thing: the history of segmentation, and much of marketing theory in general, primarily focused on business-to-consumer (B2C) markets. This doesn’t mean segmentation and personas are irrelevant for B2B, it simply means we need to account for the differences between the two types of business models.

The inability to understand the difference resulted in B2B buyer personas becoming one of the most mishandled tools in the marketer's toolbox.

Why B2B Buyer Personas Suck

This Prince Charles and Ozzy Osbourne meme makes the rounds every few months on social media. People use it to try and prove the point that buyer personas are useless in B2B.

One main reason - the data in them are too generalized and not accurate or realistic depictions of a B2B buyer.

And they’re right.

Most real-world personas don’t veer too far from that exaggeration. Not picking on this company, but here’s one from a random search:

See for yourself.

Search “Buyer Persona Template” and you’ll find some cookie-cutter versions of the above. Very broad parameters and a silly name like “Engineer Ellen”. There’s no depth about how these “buyers” make purchasing decisions and how a solution fits contextually within a buyer's worldview. Here’s a slightly better persona template from Hootsuite:

It provides more actionable insights for marketing and sales decisions, buyers' price sensitivities, competitor brand preferences and how this fictional buyer uses products. Yet the data is still mostly high-level, focusing primarily on segmentation characteristics. It’s not wrong; just incomplete.

There’s another issue. Most examples of B2B Buyer Persona templates are adapted from a B2C one. This is where B2B personas go wrong because consumers and businesses make purchasing decisions differently.

Differences Between B2B and B2C Purchases

B2C purchases are sometimes called “impulse purchases” or “less considered”. Here are the qualities of an average B2C purchase

B2C buyers are grouped into broad generalized, segments

Total addressable markets tend to be larger

Buyers are usually individuals or from a household

Brand preferences and emotions are key drivers of choice.

Buying cycles are shorter and occur more frequently

Buyers are trying to mitigate regret/remorse

Products typically align with well-known categories or lifestyles.

That last point is key. If I want to clean my kitchen floor, most methods and products used for cleaning them are similar. While there are variations in offerings—such as traditional mops versus cleaning pads like Swiffer—the differences within the spectrum of cleaning products are minimal. This means the depth of information needed to build awareness, credibility and relevance in marketing programs is shallow in B2C.

Now let’s look at how B2B purchases are different. The key differences are:

B2B buyers are often categorized into niches and specializations

Total addressable markets are smaller

Relevance and credibility are key drivers of decision-making

Sales cycles are longer, often involving many stakeholders

Buyers are trying to mitigate risk and blame

Solutions must contextually align with specific business strategies, processes and requirements

If I need to manage the supply chain of my industrial food plant, there may be many ways to accomplish this which likely require specialized skills. The strategies Business A employs may differ significantly from those of Business B, reflecting variations in business models, operational structures, core processes, internal resources, and overarching strategies. When B2B buyers evaluate market options, these factors play a critical role. And the risk of making the wrong decision is substantial—potentially leading to revenue loss or even job cuts.

This is not a monolith. B2B purchases fall on a spectrum. The consideration process for some B2B products (eg. Cloud Software tools like a calendar scheduler) that are low cost and low risk, can mimic B2C purchasing patterns.

So what does this mean?

In B2B, the way solutions align with a business’s specific strategies, processes, and requirements is inherently more complex. This means the information needed to create effective marketing, which influences purchasing decisions, must be highly detailed and tailored. Additionally, the level of trust and credibility that B2B teams must establish with buyers is significantly higher. The challenge most marketing and sales professionals are up against, is they lack the domain expertise of the B2B buyers they are trying to influence and earn the trust of.

This disconnect is why many B2B buyer personas fail to deliver value to marketing or sales teams. These personas often rely on superficial B2C-style segmentation data, rather than the in-depth insights required to address the intricate and high-stakes nature of B2B purchasing decisions.

How B2B Buyers Make Purchasing Decisions

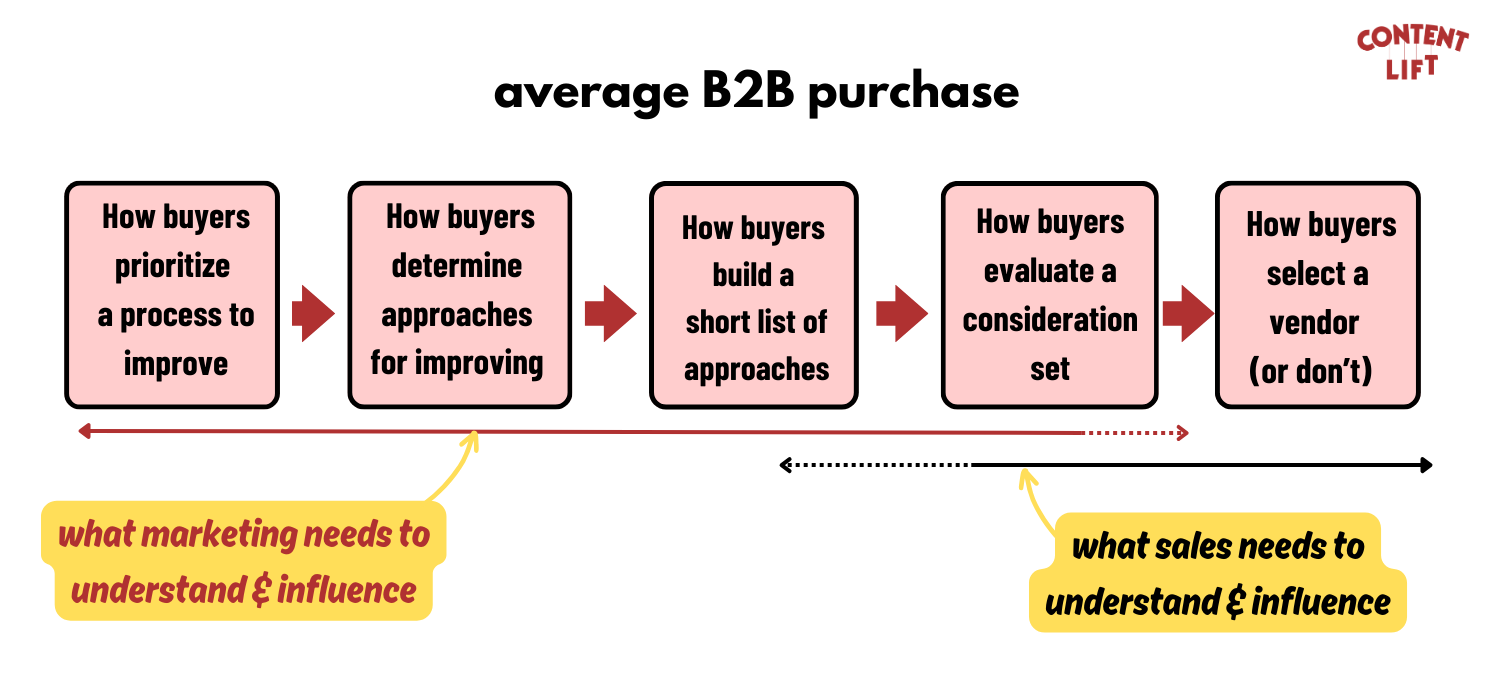

One of the biggest misconceptions marketing and sales professionals have is that the “sales funnel” or “purchasing funnel” is how B2B buyers arrive at a decision.

It’s not.

The funnel can be a shortcut for organizing marketing assets and campaigns AFTER they’re created. Funnels don’t help you understand HOW buyers make decisions.

How B2B buyers make decisions typically follow these five stages:

They prioritize a process to improve. This is when buyers move “in-market” and into a higher stage of purchasing intent. The reasons will vary based on the business needs. Maybe they have outgrown a current solution, external market factors are forcing change or an audit flagged an issue. Whatever the reason, improving a process is often the catalyst/trigger to seeking a solution.

They map out needs, goals and approaches. B2B buyers are listing out what success looks like and why. They may have a solution in mind at this point, but likely evaluating the pros and cons of various approaches. For example, they may build something in-house, outsource to a service business or maybe a combination of the two. Much of this phase is nailing down their requirements and researching available options. For some buyers this process is informal, involving one person. For others it’s weeks (or months) of alignment across multiple stakeholders, to create in-depth requests for proposal briefs (RFPs).

They build a short list of options. In B2B it’s called a “consideration set” or a “day one list”. At this point, buyers may still be evaluating various vendors, but have likely narrowed it down. Buyers typically fill their shortlist with brands they’re familiar with. This means it’s vital to be the first business they think of when they want to solve a problem.

They evaluate their choices in the consideration set. When they peel back the layers, B2B buyers will dig into:

Total costs and investments (like onboarding time), not just the sticker price

How long the vendor has been in business

Professional experience of the vendor's team

Vendors' knowledge about buyers' specific industries, roles, and processes

Peer reviews and feedback

Make a choice. Some buyers scrutinize more than others. Some stick with the status quo. Yet all the previous steps have to happen before B2B buyers choose the path forward.

The majority of B2B buyers in a segment or target market, are not actively looking to buy a solution. The data from the Ehrenberg-Bass Institute suggests that only 5% of a target market is actively looking. The remaining 95% of potential buyers may be aware of your brand and even recognize the value of your solution, but they are not currently in a position to prioritize investing in it.

There are many reasons for this but it mostly goes back to the nature of B2B purchases. These are complex decisions that often require significant resource investment and must seamlessly integrate into key business processes. If we go back to our food manufacturing plant example, they won’t be swapping out massive pieces of machinery every few months. The same principle applies to many software products—how often does a business replace enterprise-grade software? Typically, only every few years.

This is, of course, a general framework. Some markets have more than 5% of buyers actively searching at any given time. However, the scarcity of high-intent buyers remains a fundamental challenge that B2B marketing and sales teams must navigate.

One final thing. And it’s a kicker.

When your ideal B2B buyer eventually does move in-market, your business needs to be one of the first names on their shortlist. Otherwise, your chances of winning their business are almost zero. To drive this point home, a survey from Bains and Co found that 90% of B2B purchases come from a vendor “day one” list. This means B2B buyers don’t look for other options once they start seriously considering solutions.

So what does this mean for attracting new customers? B2B teams need to understand these three key things:

Most buyers are not actively looking to buy. The majority of buyers who encounter your sales and marketing efforts are not currently prioritizing a purchase. It could be months or even years before they move into the market.

Shortlists are built from familiarity. When buyers are ready to invest in a solution, they will create a shortlist of vendors they or their peers and colleagues are familiar with.

Contextual knowledge is critical. To develop marketing and sales programs that are both relevant and credible, you must deeply understand your buyer’s persona and their business processes.

The DNA of a Solid B2B Buyer Persona

So, what information should a strong B2B Buyer Persona include? Some data will resemble the structure of B2C personas, while other aspects will require greater depth. Regardless, all information should provide a relevant and contextual description of your ideal buyer and the intricacies of their business processes..

Here’s a breakdown for organizing what you need in a B2B buyer persona:

Role, Responsibilities & Other Firmographics

This is not a job description. For a B2B buyer persona, you need more details and specifics. You want to add psychographics and firmographics like:

Verticals or Industries buyers work in

Company headcount

Geographic Locations

Common Titles (*They change business to business)

Role and team size of the buyer

Annual revenue of their business

Key performance metrics (KPIs/OKRs)

Tools and tech stack

Average contract value

Key terms they use (aka vocabulary, lexicon)

Any other defining characteristics

You can have more details, as long as they are specific to defining your ideal customer. Maybe it’s the number of users for a certain piece of software. It could be the number of meetings they have per month (if you’re selling meeting collaboration solutions). Here’s an example of a how B2B Buyer Persona could look for our fictitious food manufacturer:

The key thing to remember: this is a starting point. Too often, this is where B2B teams end persona work. To build relevant and credible marketing, you need to dive deeper into how your ideal buyers view the world around them.

Process B2B Buyers Want to Improve

As mentioned, B2B solutions typically support a process. This process can be large and complex, with many moving parts and stakeholders, like in the food manufacturing example. Or it can be small and straightforward, involving just one person—such as software that schedules meetings.

Buyers assess your product or service within the context of their core processes. Mapping these processes offers valuable insights, helping you understand how your solution fits into their perspective and demonstrates its relevance and value.

Here is an example of what mapping out a B2B process could look like. If I want to sell collaboration software to long-haul transportation businesses, the diagram below shows the process of identifying and transporting loads:

You can even isolate parts of this process and expand on them further. Here are more details on the first two stages of this process, in the context of how communication is conducted throughout long-haul trucking.

The key takeaway is that buyers focus on improving their processes, whether or not they choose your solution. Understanding how their process work is critical to shaping effective marketing programs. Your content should provide buyers with valuable resources that help them improve their processes, whether or not your solution is part of the equation.

Why do this?

By offering insights and practical guidance, you position your brand as a trusted authority. This increases the likelihood that buyers will think of your solution first when they’re ready to decide, putting you at the top of their shortlist.

You can also start mapping the tools buyers use in their processes. This exercise helps identify both direct and indirect competitors while revealing potential partnership opportunities. Here’s an example using the long-haul trucking software persona:

How Problems Manifest in This Process

Sometimes in B2B buyer personas, we use terms like “pains”, “anxieties” or “challenges” to identify what prevents buyers from succeeding in the core process we mapped out.

Here’s what’s important to understand: not every barrier is a priority for buyers, especially since most aren’t actively seeking solutions. However, buyers are exploring ways to make incremental improvements. By identifying and isolating these challenges for clearly defined target customers, you can refine your content pillars to address their specific needs more effectively.

Here is an example of highlighting process problems in our example of a long-haul trucking B2B Buyer Persona:

You can see in the second row a “Voice of the Customer” quote was added to help add weight and contextualize the issue.

Mapping out challenges in a process helps identify specific content topics for resource creation. This serves two purposes:

1. Generating awareness, relevance and credibility

2. Influencing how buyers approach process improvements.

The key to success here is gathering the right data from buyers and adding it to your B2B Buyer Persona.

Specific Triggers/Catalysts for Seeking a Solution

This is where things get serious.

A formal term for this is “Category Entry Points,” though it’s often called a “Business” or “Buying Trigger.” Whatever the label, these are the events that push a buyer “in-market” and prompt them to prioritize making a change.

A trigger can stem from one or more of the identified challenges, but the key difference is that the buyer or business can no longer tolerate these barriers. Triggers can also be highly specific, such as a new hire, market expansion, launching a new product line, maintaining compliance, or other events unique to your ideal buyer’s role or business.

In the end, you may uncover over a dozen rationales for why buyers have now prioritized doing something. Here’s an example from a B2B Buyer Persona for an IT Director, now in-market to purchase backup and recovery software for a cloud software application.

Key Point to Remember: If your marketing has effectively built awareness and credibility your chances of being included in your ideal buyer’s consideration set increase significantly.

Trusted Sources of Information

In B2B marketing and sales, we often focus on identifying the "best" channels to reach prospective buyers. However, there are no universally "best" channels in B2B. This is due to fundamental differences between B2B and B2C. For example, selling floor cleaners—a low-cost, low-consideration purchase that suits most lifestyles—allows you to use a variety of channels to reach millions of potential consumers.

In B2B, where solutions are hyper-specific there are fewer channels to leverage.

Your go-to-market strategy, business maturity, and available resources will determine which channels are appropriate for your needs. The key is identifying the right channels and tailoring the information you share within them. For example, the channels and messaging used to reach Hospital IT Directors will differ from those targeting IT Directors at Fortune 1000 companies.

If you’ve completed the earlier sections of your B2B Buyer Persona, you should already have a clear idea of what to communicate and how to segment your ideal buyers. The next step is determining where to share that information. Some channels, like search and social media, are more straightforward, while others require deeper investigation. Here are a few quick tips:

Interviews and surveys with buyers can provide preliminary insights but that will still be a small snapshot. Using the firmographic and psychographic data collected for your persona, you can leverage third-party research tools like Sparktoro or Perplexity to refine your focus. For example, if you’re considering sponsoring YouTube creators who cater to IT professionals, tools like Perplexity can help generate a list of relevant creators, such as this example:

1. John Hammond - With 1.28 million subscribers, he offers cybersecurity education covering topics like penetration testing, data security, and incident response.

2. LiveOverflow - This channel has 874,000 subscribers and provides tutorials, hands-on examples, and discussions on various cybersecurity topics.

3. David Bombal - With 2.42 million subscribers, he covers a wide range of cybersecurity topics including network security, ethical hacking, and wireless security

4. The Cyber Mentor - This channel has 699,000 subscribers and offers comprehensive cybersecurity training

5. NetworkChuck - With 3.8 million subscribers, he covers networking basics, security tools, and ethical hacking in an entertaining style

6. Hak5 - This channel has 921,000 subscribers and produces shows like "Darknet Diaries" and "The Security Now Show" discussing real-world security incidents and tools

7. SANS Pen Test - While the exact subscriber count isn't provided, this channel is associated with the well-known SANS Institute and likely offers penetration-testing content

8. Black Hat - With 135,000 subscribers, this channel is associated with the premier technical security conference series

9. DEFCONConference - This channel has 203,000 subscribers and is linked to the famous hacking conference.

10. Computerphile - While not exclusively focused on cybersecurity, this channel with 2.37 million subscribers covers foundational computer science topics relevant to security.

After gathering insights into which specific channels to lean into, here’s what a very basic version could look like for an IT Director in a B2B Buyer Persona:

Key Point to Remember: It doesn’t matter what channel or format you use in your marketing investments if you don’t complete the previous sections and collect accurate insights from buyers about how and why they buy things. Without that data, no channels you choose will be successful.

How a B2B Buyer Builds a Consideration Set

Here we want to understand the information B2B Buyers need, to feel satisfied that a vendor is worth a closer look. A buyer’s objective at this stage is to eliminate less relevant and credible vendors. Their level of scrutiny increases to reduce the risk (and perceived risks) of making a poor decision. Here’s an example from a fictitious B2B buyer persona, about a Director of IT:

IT managers often begin with peers to understand what options and solutions others are using. This can be peers working in similar verticals, in different industries or even colleagues within an organization. Some seek the opinion of existing/trusted vendors or resellers such as X.

They will search for high-intent phrases or maybe a specific category of products. They read review sites, forums and Reddit about approach X and products X. Some of the larger firms will review literature from analysts. Some will also be exposed to new ideas by Industry or vertical-focused newsletters. When evaluating which vendors should move from a short list to the consideration set, buyers predominately evaluate the website and sales collateral at this stage. They look for:

Information and messaging that is relevant to (IT process X)

Product requirements and specifications (that do X)

Access to information which they can share with other stakeholders

Some participants said a self-serve demo or sandbox was helpful before talking to sales

Here is another example from the B2B Buyer persona of a Senior Marketer evaluating a demand generation agency:

When examining a website/digital footprint for the first time, marketing leads wanted the following information:

Case studies and testimonials with past clients detailing the exact process used and results

Past or current clients with similar business models or verticals to theirs

All current team members with examples of work and/or thought leadership

Technical capabilities of the team and different tools being used

Some will also evaluate the LinkedIn profiles of current and previous agency employees to gauge if there is high turnover.

On average, interviewees built an initial consideration set of 6-10 agencies. Reasons agencies did not move onto a short list were:

Not returning initial email or phone call

Confusion around what the agency does or who their best-fit client is

Buzzwords, unclear language, “fluff”

No well-known clients

A website with errors, broken links, no attention to details

Gated content that offers no value

Key Point to Remember: Some of the criteria B2B buyers consider at this stage will align with standard marketing practices. However, it's essential to identify any specific requirements buyers have. By designing marketing programs informed by the data and insights we've already discussed, you can significantly improve your chances of success.

How B2B Buyers Evaluate Their Consideration Set

At this stage, B2B buyers (or buying teams) begin to examine details more closely, often revisiting information from earlier stages but with greater scrutiny. They typically focus on features, terms and conditions, total costs (including additional fees and migration costs), onboarding processes, and specific examples of outcomes other businesses have achieved.

This is where marketing and sales activities start to overlap, making it crucial to understand the precise information buyers need at this point. While much of this data is standard in B2B transactions, the key is to tailor it to the specific details buyers are seeking within the context of the process they aim to improve.

Here’s an example of how this section might appear in a B2B Buyer Persona:

Key Point to Remember: The sales team's feedback on this section is extremely valuable. They are having many, many conversations with potential customers and can provide strong insights. After their feedback, you can run market & buyer research to fill in knowledge gaps.

Pro Tip: “stories that sell” or anecdotes about why customers chose you, over all other options, are very powerful to include in this section of a B2B Buyer Persona.

Vendor's and Solutions Buyers Compare You Against

Buyers will compare you against a range of options, ones that are similar to you and ones that aren’t. Historically, we call these direct and indirect competitors. Often buyers will evaluate you within the following categories:

Status Quo

They are trying to determine whether to change or stay the same. And this is both for first-time buyers and veterans. They are evaluating the perceived risks in making the switch and investment.

In-House Solutions

Maybe they’re considering building more intricate spreadsheets or developing an internal software tool. Whatever the solution, they are still evaluating your solution against the DIY version.

Other Category Solutions

It can be a product or a service, but buyers are evaluating you against other solutions they think are similar. You may not agree with their comparison, but it’s the perception that buyers and customers have.

Members of A B2B Buying Committee

In B2B, the person driving a purchase forward is often called “the champion.” B2B purchases typically involve multiple stakeholders, especially as the investment size and complexity increase. Who is involved and their level of influence depend on various factors.

For instance, an IT Director may only need informal approval from the CFO to purchase $500-a-year software. Since the cost and risk are low, the CFO's involvement might be limited to a quick check-in, without significantly influencing the decision.

On the other hand, a major CRM software replacement costing over $150,000 might involve collaboration between the CTO, IT team, Customer Success, and Sales departments. In this case, both the CFO and CEO likely need to approve the purchase, as it impacts multiple departments and carries higher stakes.

The depth of your mapping depends on the level of detail needed to influence the decision-making process. While you may not require fully separate personas for each stakeholder, it’s crucial to understand the specific information they rely on to make decisions.

Here’s an example of how this might look:

Value Proposition aka “Why We Win Deals”

Every business has unique advantages that make buyers choose its solution over competitors. As we’ve established, buyer preferences begin forming well before high-intent purchase activities. By deeply understanding our target market, we increase our chances of winning deals because we’ve already established credibility and trust.

It’s essential to remember that B2B transactions ultimately come down to rational decisions. While the buying journey may start emotionally, buyers will eventually evaluate how your solution impacts their business model, processes, and the perceived risks of each decision.

The reasons you "win" should be captured using the Voice of the Customer. Here’s an example of how this might look in a B2B Buyer Persona for an IT Director:

Ease of setup. Proof of concept initiated instantly and evaluated within 60 days of a free trial

No additional coding or development work required

Our team is more experienced

We allow multiple admins without additional cost

We have single sign-on authentication

Download B2B Buyer Persona Templates

We’ve put everything above into a B2B Buyer Persona template you can use today. You can choose from four different formats. You will be added to our newsletter, but you can unsubscribe anytime.